This week - Niger coup, Russia in Africa, Bolivian lithium, Sri Lanka brain drain, the IMF.

Week of July 31st, 2023.

This week, we are starting with a longer entry on Niger’s coup d’état. We are framing it in the international context of conflict between Russia and the West, which has taken a powerful relevance in Africa.

Bolivia has discovered an additional 2 million tonnes of lithium, as it sits atop the world’s largest concentration of the ore. However, as we will see, it is having a hard time extracting it. We are also devoting a small section to the IMF world outlook’s July release, and to Sri Lanka’s troubles given its debt crisis.

Finally, in the central banks section, we find that Chile has finally cut interest rates, in line with our expectations, and the Turkish lira could finally be showing signs of stability. In Lebanon, the central bank governor is quitting, after overseeing the harsh financial crisis still underway.

Presidential guards take over in Niger

Early on July 26th, presidential guards took over the palace and arrested President Mohamed Bazoum. Late that night, some of the army’s top commanders appeared on television announcing an overthrow of the government. They appointed General Abdourahmane Tchiani to head a transition government. That same day, Bazoum was due to announce he was firing the head of the presidential guard. It was likely this move that triggered the coup.

Bazoum is Niger’s first democratically-elected president and has been seeking closer ties with the West. Mainly, he has brought in French and US military support to fight Islamist militias. The two powers have units on the ground in Niger, alongside peacekeeping troops from other countries. The president’s political agenda has caused resentment, notably in sections of the army’s top brass. Bazoum suffered an attempted coup back in 2021, two days before his inauguration, as a section of the military wanted to stop him from taking office.

The international context of the coup bears high importance. Three other countries in the West African community (ECOWAS) have seen militaries take over and pursue closer relations with Russia, at the expense of France and the US. These are Mali (2020 & 2021), Guinea (2021) and Burkina Faso (twice in 2022). There are also Wagner units in the Central African Republic. Furthermore, last week we saw Putin meeting up with African heads of state in Saint Petersburg, showing that many of them will stand with him, or at least stay neutral over conflict between Russia and the West.

For France, Niger is of particular importance due to its uranium reserves — beyond attempts to influence its former colonies. Just as Germany shuts down nuclear power stations, in France they thrive, where they produce around 70% of all electricity. Furthermore, the coup could present a setback to plans for a trans-Saharan pipeline joining Nigeria with the Mediterranean. Italy was especially interested, and Bazoum had been in Rome meeting Prime Minister Giorgia Meloni and business leaders just days before the coup.

We reported on this event live on our Twitter. Make sure to follow for urgent developments, where we will draw from first-hand sources and expert analysis.

Russian grain for Africa

Russia has pulled out of the Turkish-brokered grain deal. The agreement ensured ships carrying Ukrainian cereals would be unharmed in the Black Sea. The Eastern European country’s grain accounts for 6% of global supply, while Russia is also a major producer. Ukrainian produce could also be transported by trains on land. However, Poland and allied governments in the region have blocked this, to protect their own farmers.

The deal was of special significance for poorer African nations, which rely heavily on the shipments. This card has been played by Russian president Vladimir Putin. In a summit with African leaders, he offered six of his closest allies free grain. Meanwhile, the mercenary group Wagner has continued to play a key role in Africa for Russia. An indication of this is its leader Yevgeny Prigozhin’s picture in St Petersburg with a representative of the Central African Republic. Prigozhin was meant to be in exile in Belarus. He also hailed Niger’s coup, claiming it was akin to decolonisation, offering Wagner’s services.

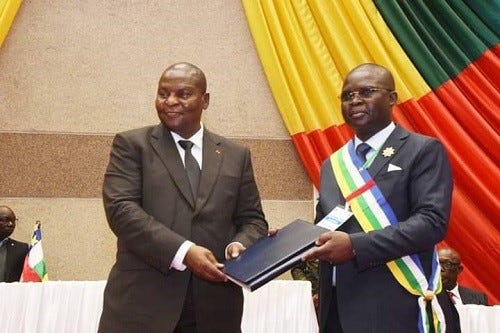

Central African Republic votes on constitutional referendum

On Sunday, July 30th citizens of the Central African Republic (CAR) participated in a vote on a constitutional referendum which could extend presidential rule and enable the current President Faustin-Archange Touadera to run for a third term. Touadera was first elected in 2016 and won again in the hotly contested 2020 elections. The new reform would see the extension of the presidential term in office from five to seven years and abolish term limits. Members of the opposition have accused the president of attempting to remain in power indefinitely and eroding democracy away.

If successful, the CAR would be joining a long list of African states which have undergone constitutional reform in recent years that granted greater power to the presidency. Notable examples include Mali in 2023, Tunisia in 2022 and Egypt in 2023. The provisional results are expected to be delivered within 8 days following the referendum, with the final results announced by the Constitutional Court on the 27th of August.

Bolivia discovers new lithium resources

Bolivia’s lithium resources could be much larger than previously expected, as a new 2 million tonnes have been discovered, bringing the total to 23 million. This means the country’s soil holds the largest amount of lithium that we know of, with neighbouring Chile and Argentina behind. Together, the three South American countries sit atop more than half of the world’s lithium resources. Note the distinction that mineral resources are the concentration of the material, whereas ore reserves are the part of the resource that can be mined economically. Chile, Australia, Argentina, and China have the largest reserves, in that order.

Bolivia has in the meantime been slow to fulfil its potential. In 2021, it produced 543 tons, while global production was 600,000 tons. The top producers are Australia and Chile. Bolivia has suffered from chronic insufficient infrastructure and, in recent years, political instability, adding hurdles to the industry’s development. In 2019, as then-president Evo Morales was about to sign a game-changing lithium deal with China, he was ousted in a coup. His party took back power a year later in an election, though events muddied the attractiveness of Bolivia.

Sri Lanka migration raises fears of brain drain

A recent report by Nikkei found that over 300,000 Sri Lankans have migrated abroad following the unrest in 2022 that forced former President Gotabaya Rajapaksa to resign. Many professionals and middle-class earners were among those who left the country, leading many to fear a brain drain effect which will cause further damage to services in the country. Since 2019, Sri Lanka has been facing a major economic crisis which led to an unprecedented level of inflation and a sharp increase in the cost of basic goods including medical supplies and fuel. Many Sri Lankan professionals moving abroad cite the attractiveness of higher pay and greater opportunities which are currently lacking in the country. Many Business leaders in Sri Lanka have also raised concerns over their inability to find new replacement staff to fill senior roles. Some, however, remain determined to stay and contribute to ongoing efforts of rebuilding the country's economy.

To address the ongoing economic crisis, the government has reached an agreement with the IMF for a $2.9 billion package, though this offer comes under the usual conditional restructuring policy enforced on governments of developing countries, which more often than not leads to further economic issues over time.

IMF World Economic Outlook

The IMF has released its world economic outlook, forecasting a fall in global economic growth from 3.5% in 2022 to 3% in 2023. Note that projections for 2024 have only been revised slightly upwards. This drop is mostly attributed to advanced economies, where growth will slow from 2.7% to 1.5%. Europe is the hardest-hit; in the euro area the forecast is 0.9% and in the UK 0.4%. Emerging market & developing economies overall are expected to sustain growth around 4%, largely thanks to Asia - notably India and China. Meanwhile, Latin America & the Caribbean is expected to see the lowest growth of the four emerging and developing regions, in large part due to high interest rates and political instability.

Central banks

As we come into August, we are expecting monetary policy decisions from Brazil and Thailand on the 2nd, India and Mexico on the 10th, and Turkey on the 24th. In this last country, we are seeing indications that the lira may finally be stabilising. The most likely scenario is that the lira has been oversold, and it will rise up for the next few months. The central bank has finally taken a hawkish turn, against expectations after Erdogan won the vote this year. However, readers should be wary of a president who can easily replace central bank chiefs.

Chile July rate cut

On July 28th, Chile’s central bank announced a rate cut of 1 percentage point to 10.25%. In May 29th, when we launched this Central Banks section, we forecast that monetary policy would have to be eased to allow for growth. Inflation has kept slowing, though it is still high at 7.6% in June – the target is 3%. Meanwhile, GDP growth expectations have been revised down by the government, to 0.2% from 0.3%. In part, this is due to copper prices falling, which is its largest export. These are seen averaging $3.85 per pound. In May, they were expected to rise to $3.86.

Lebanon Central Bank Governor leaves office

The Deputy Directors of the Lebanese Central Bank (Banque Du Liban) are set to meet after failing to find a successor to outgoing Governor Riad Salameh. Salameh is due to leave office on Monday July 31st leaving behind a controversial legacy in the Lebanese financial crisis which saw the Lebanese pound lose 98% of its value against the US dollar since 2019.

Additionally, the ongoing political deadlock in the Lebanese parliament is expected to create more challenges for Central Bank as the country struggles to find a way out of the crisis.