This week - Erdogan underestimated, Thailand elections, FDI in Mexico, Sudan conflict, Venezuela to export LNG

Week of May 21st, 2023.

FDI keeps flowing into Mexico

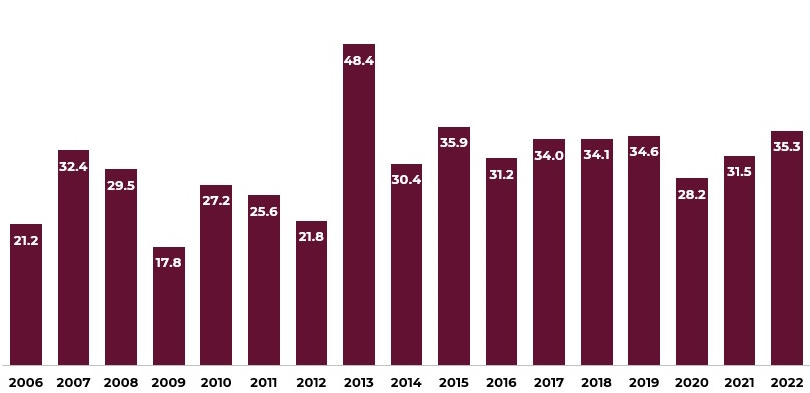

Foreign direct investment (FDI) was up 12% last year at $35.3bn, the highest figure since 2015. The breakdown is also important. Mining FDI actually fell by 66%; the rise was mostly due to manufacturing and services. For 2022, manufacturing FDI accounted for 36%. Interest in Mexican production is also forecast to rise, as it plays a crucial role right by the enormous US market. Despite warnings over President López-Obrador’s policies, Mexico’s economy has grown above expectations and FDI is yet to wane.

Nearshoring: Myth or reality?

Already in August 2022, the Economist Intelligence Unit highlighted the spike in FDI in Latin America, and in especially Mexico. Nearshoring and rising commodity prices were the two main drivers. However, the hard data is not clearly backing this argument. A report from the Federal Reserve Bank of Dallas pointed out that most new investments made in the last decade come from China. A key factor could be the current trade war; Chinese firms could bypass tariffs by using Mexico. On the other hand, supply chain relationships often take place at arm’s length - as with Foxconn producing and Apple’s products. This means that other indicators should be used to measure real investment growth. Still, the US is by far the largest sole investor in Mexico, with Canada second and China at the 10th position.

Turkey: Traders reverse bets on Erdogan loss

Investors were pricing in high chances of the opposition winning, as some polls showed a lead for Kilicdaroglu. As Erdogan showed a clear lead at the end of the first round, they attempted to reverse course sparking a sell-off in foreign-currency bonds and buying up insurance against default. Essentially, polls that favoured Kilicdaroglu were overblown in developed markets. Currently, many investors are betting on balance of payments troubles, if Erdogan continues to hold the presidency.

As we projected at Over the Hedge, Erdogan is still the overwhelmingly preferred candidate. First, as he has been able to dominate Turkish politics for 20 years and can use an array of tactics to sustain himself in power. For instance, he promised a year of free gas for households if he won, just days before the vote. Meanwhile, multiple irregularities are being reported across the country, especially in Kurdish-majority areas - in some, Erdogan has strangely doubled his share of the vote since 2018. Secondly, local pollsters based in more liberal areas such as Instanbul were likely to show a bias favouring Kilicdaroglu.

Thailand: Anti-junta parties win general elections

Thailand held its general elections on May 14 and to the surprise of many analysts, the newly formed Move Forward Party won the highest number of seats. The Move Forward Party, also known as Phung Luang Party, declares itself to be a social democratic and progressive political party whose objective is to remove the ongoing military rule in Thailand, establish a civilian government and amend the powers of the monarchy. Its current leader Pita Limjaroenrat is a businessman and politician who first joined the predecessor of the current party Future Forward Party which dissolved in 2020. Following the election results, Limjaroenrat declared to be ready to assume the role of Prime Minister and that he would be able to form a coalition government alongside smaller parties who also oppose military rule. Many of his supporters and newly elected members of parliament stressed that Thailand would be entering a new era. If successful, Limjaroenrat could pave the way to a transition away from military rule and democratise Thailand in the long term.

Despite these ambitious goals, there are still many challenges to overcome such as the current constitution which grants the military the power to appoint members of the senate, a third of which are linked have links to the army or the police. The election results are due to be formally ratified by the election commission within 2 months.

Sudan: New cease-fire announced

As the conflict in Sudan reaches its sixth week, reports from the US and Saudi Arabia have announced a new 7-day ceasefire starting from the 21st of May. Numerous ceasefire attempts were made before this, all of which have been unsuccessful so far as both sides continued fighting. The US State Department expressed optimism that both sides would uphold the agreements of the ceasefire, pointing to the fact that this time both parties were present and signed the agreement. US Secretary of State Antony Blinken expressed hope that both sides would soon engage in negotiations to start the peace process.

Embassies targeted

Reports from the Sudanese capital Khartoum note that foreign embassies have been targeted in the fighting by unknown military groups. Qatar and Jordan have said that their embassies had been ransacked on Saturday alongside UN outposts.

Mounting casualties

So far, the conflict in Sudan has claimed over 1000 lives as of 21 May 2023 of which over 400 are reported to be civilians with thousands more injured. The United Nations also stated that the ongoing fighting has resulted in nearly 1 million people being displaced with around 250,000 seeking refuge.

Chinese and European energy firms in Venezuela

Venezuela’s energy sector could be on track to see further growth thanks to foreign interest in natural gas. On one hand, Italian Eni and Spanish Repsol will soon gain their license to export LNG from their joint-owned Cardon IV operation. So far, the resource is used for domestic consumption, although the vast reserves off the coast present a potential for profitable exports. In 2022, the two oil majors attempted to reach an agreement with Caracas over oil, but the latter wanted to receive cash for payment instead of solely repaying debt.

This year, Venezuela’s fossil fuel exports have continued to make a recovery. The main driver has been Chevron, which was allowed to resume operations in November. Around this time last year, a similar increase in oil revenues was largely due to high prices as war in Ukraine started. However, reports have shown a steady increase in production, which is largely behind the stability in Venezuela’s currency.

Chinese investors are back

New deals point to a return of Chinese investors into Venezuela. While the two countries are political allies, China has not made any new, significant investments in the American country since 2015. Now, however, there are fresh talks for economic agreements, some including China National Petroleum, which could also buy up natural gas, as Eni and Repsol.

As Venezuela is exiting a period of full-blown economic collapse and political isolation, some investors - especially from emerging markets - are eyeing up new opportunities. Furthermore, the management of state-run firm PDVSA is changing radically under the current head and oil minister Pedro Tellechea, alongside its strategy, after billions went missing in a corruption scandal uncovered this March.

This week, we would also like to present our other products to all our subscribers. We offer commissioned work and bespoke consulting to our paid subscribers. Paid subscribers can approach our team for commissioned work. We are available at: overthehedgeem@gmail.com.

Research Reports: Our market research reports provide you with comprehensive information on the target market, including economic trends, exclusive insights from primary sources and sector-specific prospects.

Country Risk Assessments: Our country risk assessments help you to identify and mitigate the risks associated with investing in a particular country.

Bespoke Consulting: We offer our paid subscribers an ad hoc consulting service on our areas of expertise. We are available Monday to Friday, from 9 am to 6 pm London time.

News Service: We publish a weekly newsletter and regular articles to stay on top of significant developments in our areas of expertise. This service is available to free subscribers. The newsletter is sent at 9 am London time.