This week - Menendez scandal, Venezuela primaries, Tanzania investment, Saudi-Israel relations, SPR running low, Sahel insecurity.

Week of September 25th, 2023.

This week we have a particularly long newsletter. We are starting off with a scandal in the Capitol. We believe that Senator Robert Menendez’s indictment will have an effect on Washington DC’s strategy towards Venezuela and Cuba. From there, we are offering a brief update on Venezuela’s long road to elections. This needs to be considered as Russia bans diesel and other fuel exports.

We are also discussing growing investment in Tanzania, new developments in the Saudi-Israeli normalisation process, and a new alliance between Sahelian states. If you just came for our emerging markets monetary policy commentary, you can scroll straight to the end, as always. We have central bank news from Latin America, the Gulf Cooperation Council, and Nigeria.

Bob Menendez scandal: Blow to sanctions policy

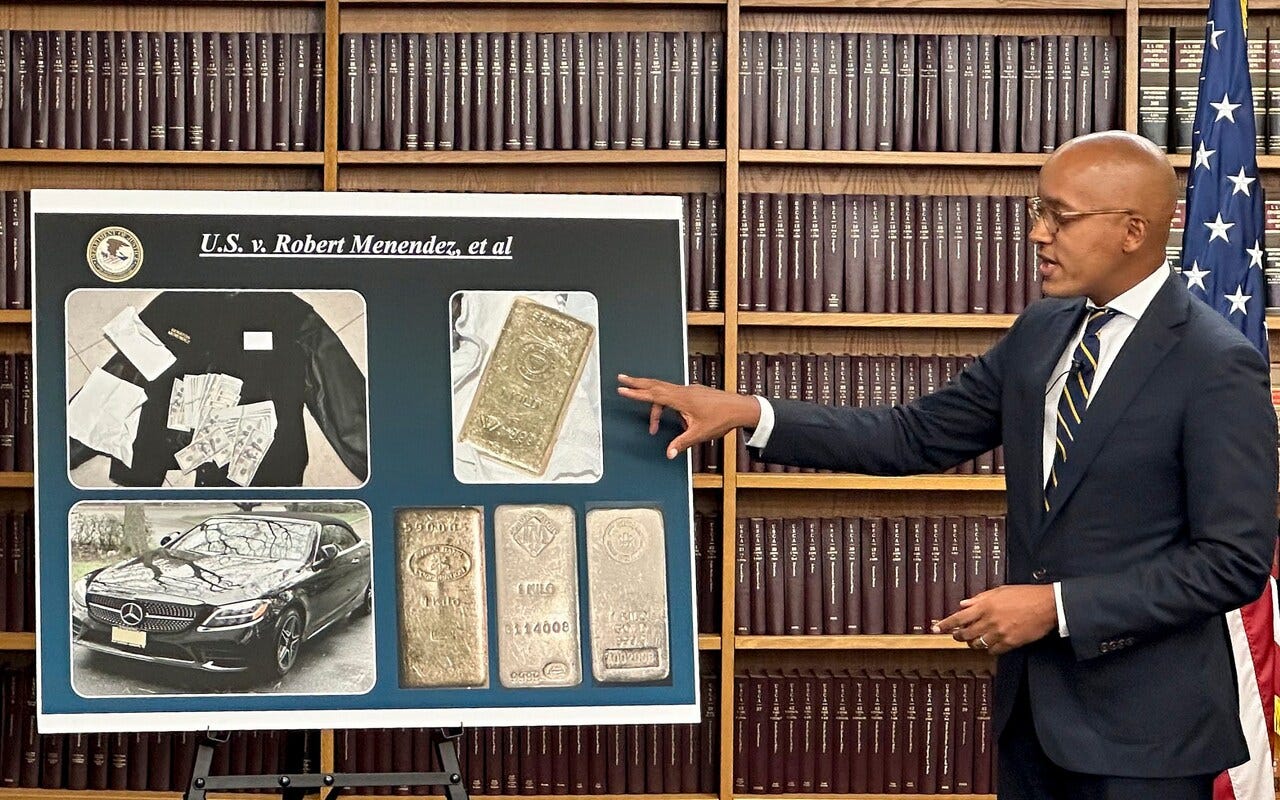

Senator Robert Menendez (D-NJ), a key proponent of tighter sanctions on Venezuela, Cuba, and Nicaragua, has been indicted with new corruption accusations. Given the timing, this could allow for a more flexible policy from the White House.

Senator Menendez has been charged for receiving gifts in the form of “cash, gold, a Mercedes Benz and other things of value – in exchange for Senator Menendez agreeing to use his power and influence to protect and enrich [three New Jersey] businessmen and to benefit the Government of Egypt”.

The timing is key. As chair of the Senate Foreign Relations Committee, Menendez was trying to pass through legislation to enshrine sanctions on Venezuela in law. Simultaneously, the Biden administration is negotiating sanctions relief with President Nicolas Maduro’s government, as part of a broader deal that could involve democratic guarantees for Venezuela’s 2024 election. Since this week, the White House is also expected to ease some restrictions on Cuba, “to allow more US financial support of small businesses”.

The Venezuelan government has also been in coordination with four opposition state governors to jointly demand an end to economic sanctions. In the past, the opposition played an essential role in giving political cover for the Trump administration’s “maximum pressure” strategy.

Venezuela 2024 election update

The opposition’s primaries are nearing, and some divisive issues are surfacing. Already, there is a debate since the frontrunners – Maria Corina Machado and Henrique Capriles – are barred from taking public office. The primaries could also be without enough resources, as they have launched a new lottery. The National Electoral Council (CNE) has offered technical assistance, although some candidates think it is planning to interfere in the vote.

This last week, the conflict with Guyana over the Essequibo region has resurfaced. The government in Georgetown auctioned offshore oil blocks in disputed waters. Caracas responded with a protest, and is launching a vote on whether it should continue pressing its claim. This issue unites virtually all Venezuelans, and could be used to bolster support for the government and divert attention from the primaries, according to sources in the opposition alliance, the Plataforma Unitaria. The same sources also claim that the security forces’ re-capturing of an inmate-run prison is also part of this plan, given the timing.

Russia bans fuel exports — SPR running low

Moscow has banned diesel and gasoline exports from September 21st. The stated reason has been to stabilise the domestic market, which was seeing some shortages. The ban will remove 1 million barrels per day (mbpd) of motor fuel exports, 80% of which are diesel. In Europe, gasoline prices rose by 2% on the day to almost $1,000 per metric ton. The new measure presents a further tightening of fossil fuel markets. On September 17th, Bloomberg already reported that “the world’s oil refiners are proving powerless to make enough diesel”. In fact, prices of this derivative product have risen outpacing crude.

In the US, the Strategic Petroleum Reserve (SPR) is facing a dilemma. It is running out of supplies, as it attempts to flood the market and offset supply cuts. Soon it will have to restock, but prices hovering around $90 a barrel are 30% above the target price around $70. Over the Hedge has access to US-based investors who believe that the Biden administration will have to source oil from sanctioned Venezuela and Iran. The former’s heavy crude is not compatible with the SPR, but it would nonetheless allow for an easing of prices if it were brought on the official market, and production grows with foreign investment.

Tanzania sees growth in investment

A report by the Tanzania Investment Centre showed that investment in Tanzania had grown by around 120% in the past month, with a majority of the funds directed towards its agricultural sector. Findings from the report assessed that funding for development projects in the country increased from 1.06 trillion Tanzanian Shillings (638 million USD) in July 2023 to 2.33 trillion Tanzanian Shillings (929 million USD) in August 2023. Revenue from Tanzania’s agricultural sector has also witnessed significant growth in this period from 571 billion Tanzanian Shilling (228 million USD) to 849 billion Tanzanian Shilling (340 million USD).

Economic forecast

According to the World Bank, Tanzania’s economy has performed relatively well in 2023, having one of the fastest growing economies in the continent in spite of challenges caused by outside factors such as recovery from the COVID-19 pandemic and the war in Ukraine. Experts assert that Tanzania’s economy will continue to experience moderate growth coming into 2024 and may potentially expand by 6% compared to 5.1% in 2023.

Saudi-Israel normalization imminent?

2023 has proven to be an interesting year for Saudi Arabia which has made some unexpected moves, beginning with the diplomatic reconciliation with its regional rival Iran in March and most recently with ongoing talks to normalize relations with Israel. Like most Arab states Saudi Arabia has never recognised Israel as a sovereign nation on the basis of its settler colonial state origins and continued occupation of Palestinian lands. The 2020 Abraham Accords pushed many Arab states including Morocco, Sudan and the UAE to gradually recognize Israel and establish diplomatic relations. Many at the time had anticipated a domino effect that would span all nations within West Asia and North Africa to recognize Israel, however, this did not unfold as anticipated.

Saudi Arabia’s de-facto ruler Crown Prince Bin Salman has stressed that while both nations are getting closer to normalization, the Kingdom will not abandon its commitments to the Palestinian cause. Much like with the Abraham Accords, the US is mediating talks between Israel and Saudi Arabia, with officials optimistic about a breakthrough, though conceded that it would take time.

For its part, Palestine has maintained criticism over the recognition of Israel without concessions from the latter regarding its occupation of Palestinian territory and ongoing apartheid against Palestinians. So long as Palestine continues to be sidelined in talks of regional peace and normalization with Israel, the Palestine-Israel conflict is unlikely to de-escalate anytime soon.

Alliance of Sahelian States

The military juntas in Burkina Faso, Mali, and Niger have signed a defensive alliance on September 16th. Until recently, army officers in the region were already in close communication through the Western-backed G5 Sahel, which also includes Mauritania and Chad. The three countries are bound to collaborate not just in case of foreign invasion: without US and European support, they face an uphill battle against insurgents.

In Mali, the government has called on volunteers and reservists to join the army, while independence-day festivities were cancelled due to conflict with rebels. The Tuareg militias in the northern Azawad region recently published a video flexing their numbers. Burkina Faso’s parliament has approved sending its troops into Niger.

Sanctions are also biting hard in Niger. The military junta that deposed President Mohamed Bazoum in July has said there are difficulties importing medicines and other essential goods. The country’s trade with global markets used to take place primarily through the port of Cotonou, in Benin. Borders with their neighbour are closed, as with Nigeria, the other coastal state on its southern border. Foreign mining firms try to push for business as usual (1, 2), but they might have to withdraw if sanctions and insecurity persist.

Central Banks

Another country has joined the easing cycle in Latin America: Peru, which cut its rate by 25 basis points to 7.5%. It is following decisions that are continued in Chile and Brazil. In Colombia, the Finance Ministry and business leaders have also called for rate cuts, while the central bank is yet to change its position since April this year.

On September 22nd, central banks in Gulf Cooperation Council (GCC) countries and Jordan held their target rates, mirroring the US Federal Reserve. The alliance did so to protect their currency pegs to the US dollar. Analysts from BMI (a service from Fitch) forecast that the GCC plus Jordan will maintain current rates, to drop them by the second half of 2024 by 100 basis points.

Nigerian president Bola Tinubu has nominated banker and stockbroker Olayemi Cardoso as the new governor of the Central Bank of Nigeria following the resignation of former governor Folashodun Shonubi. Following this appointment, the Central Bank scheduled its meeting on monetary policy for the 25th and 26th of September. likely topic of discussion will likely include strengthening the value of the Nigerian Naira and tackling the country’s high inflation of 18.5%.

The editors: Elias Ferrer and Slim Mezlini.