Will Niger Troubles Squeeze Uranium Supply?

Among the instability, some insiders say it will be "business as usual".

Niger, a country in the Sahel with important uranium supplies, has been on the news since an unexpected coup d’état overthrew the nation’s president on July 26th. Since, there have been economic sanctions and diplomatic pressure from many of its neighbours, demanding the toppled government is reinstated. Even a military intervention is on the table. Fears are growing that political troubles could cut the supply of uranium to global markets.

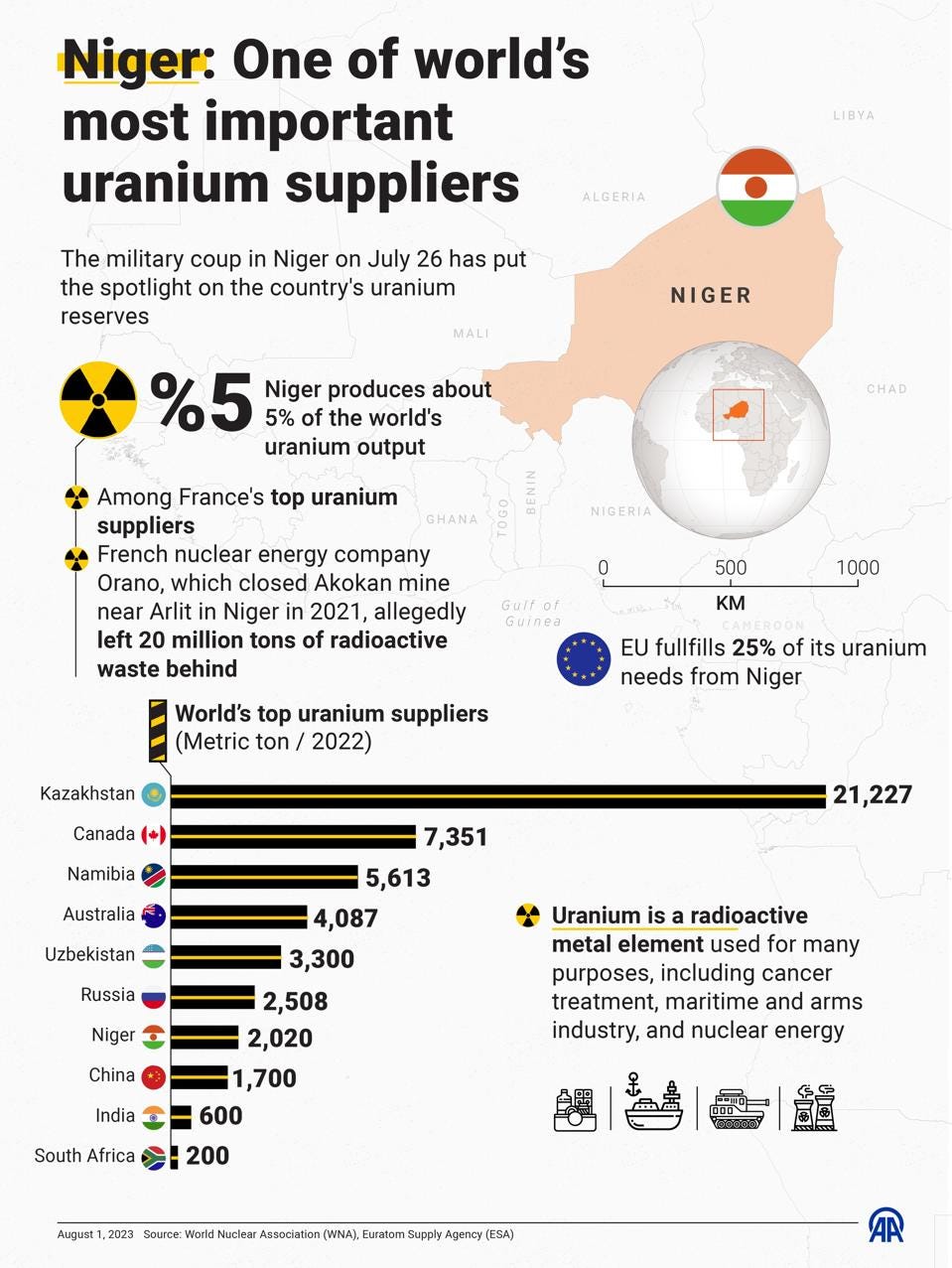

As we published in a previous article, Niger accounts for 5% of the world’s supply of uranium. Although this is a small figure, complications in the country could trigger a scramble between importers. Europe sources around 20% of its uranium from Niger, and it is especially important for France, a major nuclear energy power. What is perhaps more significant, however, is the large potential of the Sahelian nation.

According to an article by the Huffington Post, in the lead up to the military takeover, mining corporations had been building up their operations. Niger was once the 4th largest uranium producer, while now it is the 7th. Global Atomic Corp., a Toronto-based firm, had been exploring in the country for 18 years. Only this July it finished building the access ramp to the underground area holding the ore, in the Dasa mine. Days later, the presidential guard took the elected president prisoner.

For Global Atomic, they say it will be business as usual. Although there were false reports that Niger was to ban uranium exports to France, this did not to materialise. On the other hand, there are rumours that the military junta will open up to competitors. The implication is that Canadian, US, Russian, Chinese firms and others could enter a market that has been effectively exclusively for French capital.

It is true that global uranium prices have risen since the coup in Niger, although only slightly. A much larger driver has been the buildup of nuclear reactors, especially as a response to energy crises last year. The price per pound rose from around $30 per pound in 2021 to $50-$60 since 2022. Even this year, the pound of uranium has steadily risen from $50 to $56 before the coup. The subsequent $2 rise could be attributed to either political troubles, or the existing march continuing its pace.

In part, the military takeover in Niger has not upset markets significantly, unlike Russia’s war with Ukraine, because of the nature of nuclear energy. It is not like energy produced by fossil fuels, which needs constant replenishment. Normally, nuclear reactors only require refuelling every few years.

Fears are rather set towards the future, and Niger’s full mining potential will have to be exploited if the current path is carried out. A report from the Center for Growth and Opportunity argues that “by 2035, the global demand for uranium will reach 209 million pounds annually, but supply will fall short at 114 million pounds—a little over 54 percent.” The same organisation also points out that it will be a key issue for the US: national buyers increasingly source their uranium from abroad, and hardly buy any domestic ore – only 20,000 pounds, against 41.3 million imported, in 2021. Up until the 1980s, the US used domestic uranium ore for most when not all its consumption. Furthermore, 50% came from Kazakhstan and Russia, a situation that could be changing due to sanctions.

New nuclear reactors are being built around the world, notably in fast-growing economies like China, India, and Poland. Global demand will need not only Niger’s production, but also a greater share of its unexploited capacity. If confrontation persists, the potential of the country will be damaged by sanctions and possibly armed conflict. However, a resolution that brings openness and stability could put Niger at an advantageous position in the global drive for nuclear energy.